Smartphones are important in our lives. They’re also changing how we handle money. Finance apps make it easier for people to learn about money and manage their finances. They put important financial information right in your pocket. Before getting into details, check out the latest insights in gambling, sports, and crypto at Vave Casino Blog.

What is Financial Literacy?

- Financial literacy is about knowing how money works and managing it well.

- It helps you feel sure about handling money in your daily life.

- A key part of financial literacy is budgeting, which means planning how to use your money so you don’t overspend.

- Knowing about different ways to invest and managing risks helps you grow your money.

- You should be aware of various financial products like bank accounts, credit cards, loans, and insurance.

Why Financial Literacy Matters

Many people struggle with understanding finances. This shows a clear need for simple tools that help with money decisions. Improving financial literacy can build confidence in managing money. This helps prevent costly mistakes and supports personal goals. When you become financially literate, not only do you reap the benefits, but you also boost the economy thanks to your efforts.

Learn About Money Anytime

Finance apps act like mini-schools for your pocket. They provide lots of learning materials about money. Users can find interactive tutorials, read helpful articles, watch fun videos, and listen to podcasts.

These apps teach you how to budget, invest, and understand financial terms. Learning about finance becomes simple and accessible. It helps users build confidence and skills to manage their money effectively, anytime and anywhere.

Easy Budgeting Made Possible

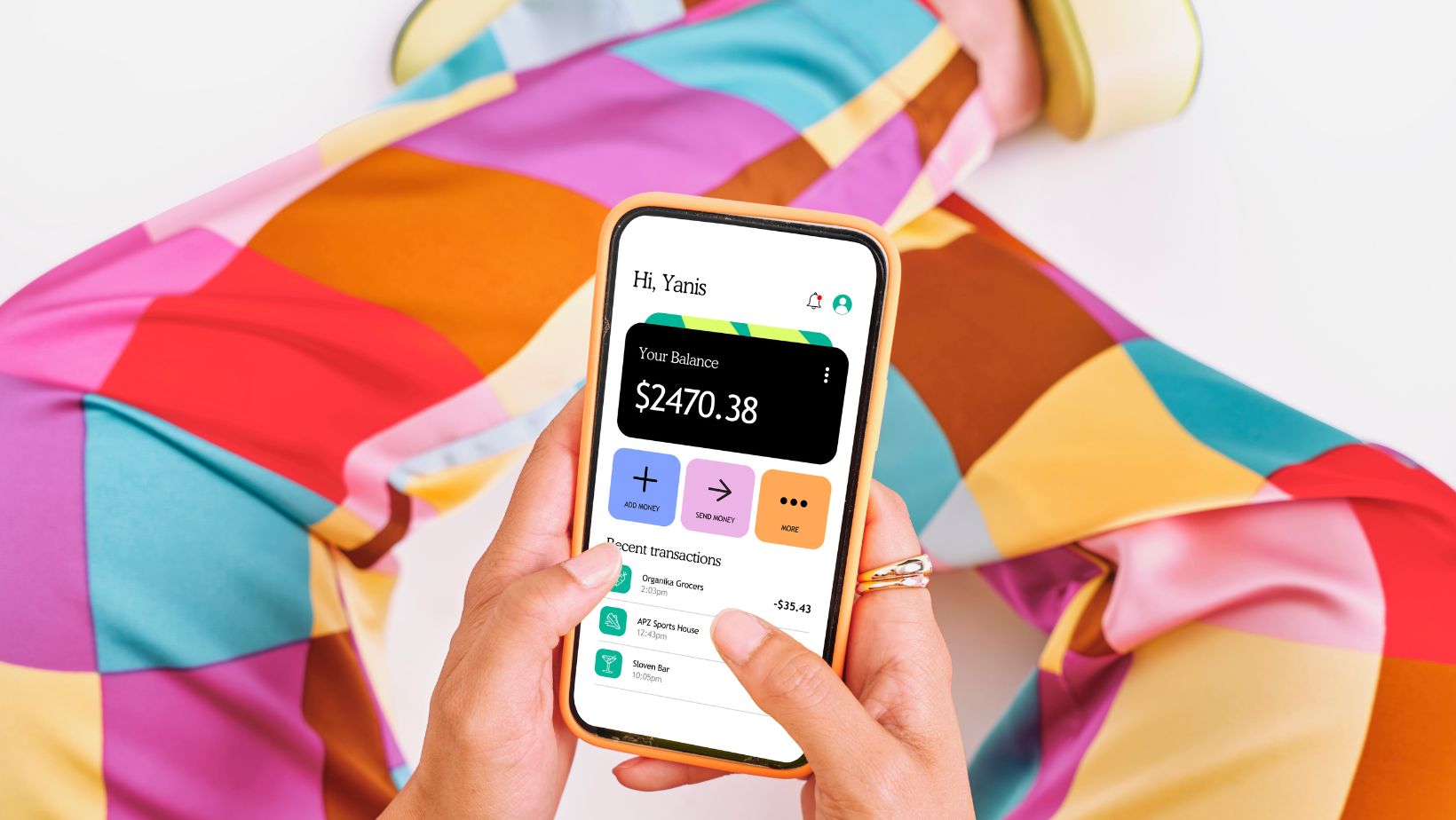

Finance apps simplify budgeting. You can track your money in real-time without doing the math yourself. Just enter your income and expenses on your phone.

Don’t forget that these apps are customizable, meaning they can actually fit your needs. You can create categories like groceries or entertainment. They also offer tips for smart spending. The app can even notify you if you end up overspending.

Planning for Your Future

If you’re saving for something big, getting ready for surprises, or thinking about retirement, these apps have what you need. They provide personalized advice based on your financial situation. This way, you make smart choices for the future.

Easy Investing

Investing is much simpler now with finance apps. You can start small on user-friendly platforms. Many apps help you create a portfolio that fits your goals and comfort level.

They also offer helpful tips and automatic features, which end up making it easier for anyone to grow their money.

Keeping Your Data Safe

Finance apps prioritize your security. They use strong protection methods, like encryption and multi-factor authentication. They do this to keep your financial information safe. They also follow strict privacy guidelines to ensure your data is confidential.

Making Learning Fun

Gamification is changing how finance apps help users learn. These apps use features like rewards, challenges, and leaderboards to make learning enjoyable. Users can earn badges for finishing lessons or reaching savings goals, which can make finance feel fun instead of boring. This fun approach keeps users excited to learn and practice their money skills. It also encourages friendly competition among users. This supportive environment boosts financial knowledge and makes learning memorable.

Instant Money Feedback

A great feature of finance apps is their ability to provide instant feedback on your finances. Users can quickly see how they are spending, how their budget is doing, and their financial health. This immediate feedback helps users make quick decisions. It lets users change their budgets or spending when needed. If an app sees that you’ve spent a lot quickly, it can alert you to check your purchases. This helps you stay aware of your finances and avoid overspending or debt. As a result, it builds their confidence and financial skills.

Connect with Others

Many finance apps now have social features that let users connect. This could be through forums, groups, or shared goals. Users can talk to their friends or even meet new people who share similar interests. Interacting with others can boost financial knowledge by sharing different ideas and experiences.

Users can ask questions, share tips, and celebrate successes together. This kind of help becomes even more useful to those who are new to money management. With a community backing them, users feel more confident making smart financial choices.

The Changing Face of Finance Learning

Finance education is changing, with finance apps taking the lead. We can expect more personalized features like AI-based financial advice and customized learning content. This will make financial knowledge easier for everyone, regardless of their background. As more people prioritize financial literacy, finance apps may partner with schools to create combined education programs. By merging technology with traditional learning, the future of finance education looks bright. This will help people manage their money better and work toward financial independence and security.